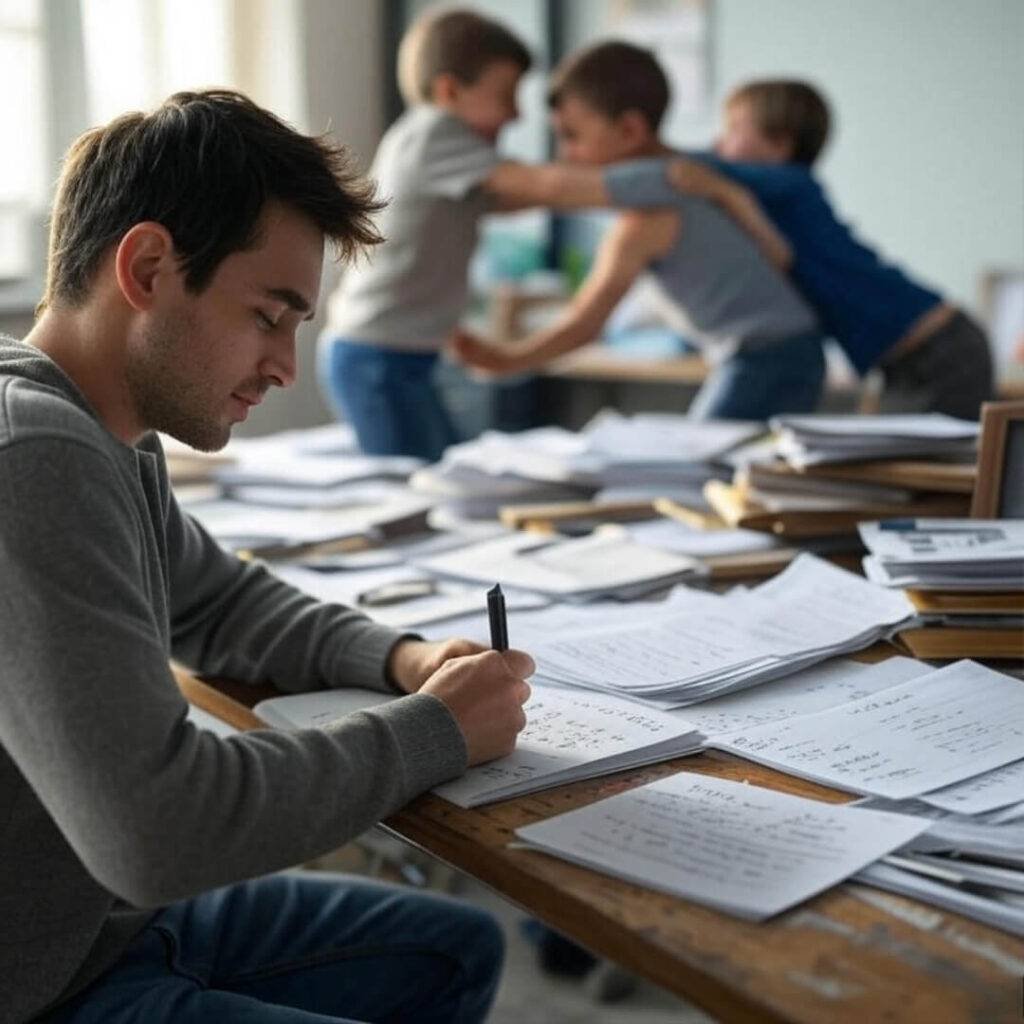

Estate planning for parents is no joke, okay? I’m sitting in my cluttered Ohio living room, surrounded by Legos and a mystery stain on the couch—smells like old applesauce, maybe? My kids, Sophie (6) and Liam (4), are screaming about who gets the blue crayon, and I’m over here sweating about what happens if I and my wife aren’t around. I spilled coffee on my jeans this morning while googling “estate planning for parents with young children,” and yeah, I cried a little. Not proud, but it’s real. The thought of my kids without us? It’s like a punch to the gut.

I used to think estate planning for young families was for old rich dudes with yachts. Nope. It’s for me, a 35-year-old hot mess who forgets where he parked his car. Last year, my neighbor Jen had a car accident—she’s fine, but her kids? They were almost left in limbo because she didn’t have a plan. That lit a fire under me, so here’s my estate planning checklist, typos and all, from one frazzled parent to another.

My Kinda-Sorta Estate Planning Checklist for Parents

This is my attempt at an estate planning checklist for parents with young kids. It’s messy, like my life, but it’s what I’ve got so far. I’m no expert—just a dad trying not to screw this up.

1. Write a Will (Don’t Be a Dummy Like Me)

You have to have a will. I dodged this for years, thinking it’d be a nightmare. Spoiler: it kind of was, but it was worth it. A will says who gets your stuff and who looks after your kids. I met with a lawyer last week—my hands were so sweaty I almost dropped my phone. Check out Nolo’s will guide for the basics.

- Pick a guardian: I and my wife fought over this. I wanted my brother (fun uncle vibes), and she wanted her cousin (super responsible). We picked her cousin, Sarah, but I’m still salty.

- Backup plans: I forgot you need a backup guardian. My lawyer was like, “Uh, dude, what if Sarah can’t?” Mind blown.

- Update it: I spelled Sophie’s name wrong in the first draft. Don’t be me—double-check and revisit every few years.

2. Trusts Aren’t Just for Fancy People

Trusts sound like something from a soap opera, but they’re legit for estate planning for young families. I set up a revocable living trust, and it felt like I was playing grown-up. I almost cried when I realized it’d protect Sophie and Liam’s money. Investopedia’s trust guide saved my bacon here.

- Control the money: I set it so the kids can’t touch it ‘til they’re 25. Liam’s obsessed with toy cars—imagine him at 18 with a bank account.

- Choose a trustee: I picked my mom. She’s stingy but fair. I trust her not to buy a sports car with it.

- Fund it, duh: You have to put stuff in the trust. I forgot to transfer our savings at first—oops.

3. Life Insurance (Because Kids Aren’t Cheap)

I didn’t have life insurance until Liam was born. Big mistake. Got a term life policy last year, and it’s a lifesaver for estate planning for parents. It’s like a backup plan for my wife and kids. I used Policygenius to shop around, and it wasn’t awful.

- Get enough: I went for 10x my income. Kids are expensive, y’all—diapers alone broke me.

- Name beneficiaries: I messed up and listed my mom first. Fixed it to my wife and the kids’ trust. Check yours.

- Compare prices: I saved a couple hundred bucks by shopping around. Felt like a win.

3. Guardianship Planning Is Heartbreaking but Necessary

Choosing who raises your kids if you’re gone? Ugh, it’s the worst. I bawled in the Target parking lot thinking about Sophie and Liam without us. Estate planning for parents with young children means facing that fear. We wrote a letter to Sarah about our kids—Sophie loves dance, and Liam’s a dinosaur nerd. It’s not legal, but it felt right.

- Talk to them: Sarah was shocked but said yes. We had an awkward Zoom call to talk it out.

- Put it in writing: I almost forgot to add it to the will. Don’t skip this step.

- Money matters: Sarah’s got her own family, so the trust will help with costs.

4. Organize Your Stuff (I’m Still Bad at This)

I’m a disaster at organizing. My “system” was a grocery bag until last month. Estate planning for young families means getting it together. I got a cheap safe from Walmart and stuffed everything in: will, trust, insurance, and bank stuff. Consumer Reports has good tips.

- Make a list:I wrote down accounts and passwords (encrypted; I’m not that dumb).

- Tell someone: My wife knows where the safe is. I forgot to tell my mom—gonna fix that.

- Digital stuff: I still don’t know how to pass on my Spotify account. Help?

My Epic Fails (Learn from Me)

I messed up a ton. I thought estate planning for parents was just a will—wrong. I didn’t fund the trust at first, so it was useless. I also listed the wrong beneficiary on my insurance (sorry, Mom). Oh, and I lost our marriage license for a month—it was in Liam’s toy box. Estate planning for young families is a mess, but you figure it out.

Wrapping Up My Hot Mess of a Plan

Estate planning for parents with young children is heavy, y’all. I’m sitting here with a juice stain on my shirt, Sophie yelling about glitter, and Liam roaring like a T-Rex. But every step I take feels like I’m protecting my kids. It’s not perfect—I’m not perfect—but it’s something. If you’re a parent, don’t wait like I did. Start with a will, cry a little, and keep going. Got a wild estate planning story? Share it below—I need to know I’m not alone in this chaos!