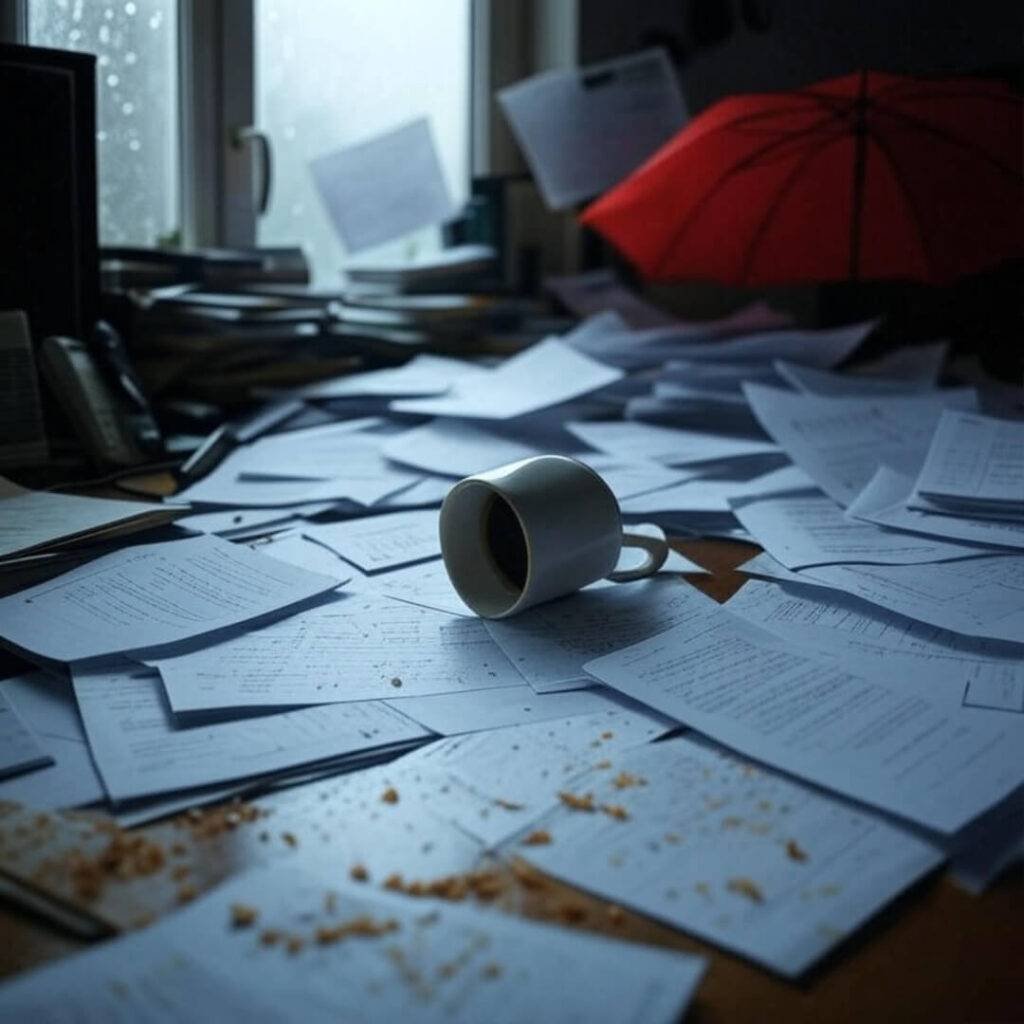

Protecting assets from creditors is, like, my whole deal right now, as I sit here in my tiny Seattle apartment, rain hammering the window like it’s got a personal grudge. My coffee’s cold, and my desk is a disaster—bills, a legal pad with “SAVE YOUR STUFF” scrawled in Sharpie, and a half-eaten bagel from yesterday. A couple years ago, my coffee shop went belly-up, creditors were circling like sharks, and I was legit panicking I’d lose my house, my car, and my freaking sanity. So I dove into figuring out how to shield my wealth—or, y’know, the scraps I had left. This is my raw, messy, slightly embarrassing take on it, mistakes and all, straight from my current life in the US. I’m no expert, just a guy who’s been through the wringer.

Why Protecting Assets from Creditors Feels Like a Bad Spy Movie

Seriously, learning to protect your assets is like starring in a low-rent thriller, hiding your cash from the bad guys. Back in 2023, my coffee shop—ironic, right, with the cold brew I’m clutching?—tanked hard. Creditors were calling, and I was up at 2 a.m., Googling “how to stop creditors from taking my house” while stress-eating stale pastries. I learned quickly: you have to be proactive about safeguarding finances, not wait till the vultures land. Waiting’s like locking the safe after your gold’s already gone. I wish I knew that sooner.

- Get a head start: Start protecting assets before you’re screwed. It’s like grabbing an umbrella before the rain—speaking of, mine’s still outside, getting soaked.

- Know your risks: Business owners or folks with loan guarantees (yep, me) are big targets.

- Don’t just sit there: Creditors don’t mess around, but there are legal ways to keep them at bay.

Check out Nolo’s guide on creditor lawsuits for more on why creditors come knocking.

My (Kinda Clueless) Strategies for Shielding Wealth

Here’s the real talk on what worked for me when it came to protecting assets from creditors. I’m no lawyer—hell, I once thought “LLC” stood for “Lots of Legal Crap”—but I stumbled through some strategies with help from folks who actually know stuff.

Trusts: My Financial Fort Knox (Sort of)

Trusts are like putting a giant “KEEP OUT” sign on your assets. After my shop crashed, I set up an irrevocable trust. It’s like handing your assets to someone else so creditors can’t touch them. I was in a lawyer’s office, rain dripping off my hoodie, feeling like I was signing my life away. But it saved my savings, my house, and my peace of mind. Well, mostly.

- Irrevocable trusts: These are the real deal for creditor protection. Once stuff’s in, it’s not “yours” anymore.

- Domestic asset protection trusts (DAPTs): States like Nevada or Delaware are solid for these. I picked Nevada and felt kind of badass.

- Get a lawyer: I found one through FindLaw, and they didn’t laugh at my dumb questions.

LLCs: My Oops-I-Did-Something-Right Moment

So, last year I started a side hustle selling custom mugs online—can’t escape the coffee life, I guess. Set up an LLC to keep it legit, and holy crap, it’s a lifesaver for protecting assets from creditors. If your business gets sued, they can’t usually touch your personal stuff. A supplier came after me for a late payment, and my LLC was like, “Nope, my bank account’s off-limits, buddy.” Wish I’d done it sooner.

- Keep it separate: Business and personal assets don’t mix. I learned that after screwing it up big-time.

- Pick the right state: Wyoming’s great for LLCs, but I stuck with Washington because I’m lazy.

- It’s not that expensive: I used LegalZoom and didn’t go broke.

Homestead Exemptions: Saving My Crappy Little House

This one’s personal. My Seattle house—small, creaky, and smelling like wet dog when it rains (so, always)—is my safe space. Washington’s got a homestead exemption that protects your home from creditors, up to a point. I filed for it last year, papers scattered on my kitchen table, rain so loud I could barely think. It’s not perfect, but knowing my home’s safer makes me sleep better. Sometimes.

- Check your state:Homestead laws are all over the place. Washington’s decent; others, not so much.

- File early: Don’t wait for a lawsuit. I almost did, and my heart was in my throat.

- It’s got limits: Doesn’t cover everything, like if your mortgage is huge.

Read up on homestead exemptions at Rocket Lawyer.

Where I Totally Screwed Up Protecting Assets from Creditors

Oh, man, I messed up so bad. Like, I thought transferring money to my cousin’s account would “hide” it—yeah, that’s called fraudulent transfer, and it’s a big no-no. Got a lecture from my lawyer while I sat there, rain-soaked and humiliated. Also, I waited way too long to get help, thinking I could DIY my way through legal asset defense. Spoiler: I couldn’t. I was a wreck, crying over spreadsheets in my PJs, the rain making everything feel like a sad movie.

- Don’t hide stuff: Courts will find out, and you’ll be in deeper crap.

- Get help ASAP: Lawyers cost money, but losing everything costs more.

- Don’t ignore mail: I skipped a creditor letter once and thought it’d vanish. Nope. Now I check my mailbox like it’s a bomb.

Wrapping This Mess Up: My Take on Financial Security

So, yeah, protecting assets from creditors is like wrestling a bear in a rainstorm—messy and scary, but you can do it. I’m still a work in progress, checking my bank account like it’s going to stab me in the back. Trusts, LLCs, homestead exemptions—they’re my lifelines. If I can figure this out, spilling coffee and forgetting my umbrella in the Seattle rain, you can too. Got questions? Talk to a lawyer or drop a comment. I’m just a dude with a cold coffee and a story, but I’m rooting for you.